Estate Planning Attorney Helping Clients in Northern Kentucky

Estate planning is not the most fun thing in the world. However, it need not be frustrating, unduly expensive, or time-consuming with the right estate planning lawyer.

So, what is estate planning, exactly?

I could give you a lawyerly answer, but this one will suffice:

Critically, you must make estate plans in advance before anything bad happens. Otherwise, it’s often too late, and a real mess can be left for your loved ones to fix.

That is not the legacy that you want to leave behind.

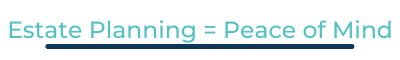

How Does Estate Planning Give Peace of Mind?

Estate Planning Protects Children

For parents who have minor children, the most important estate planning goal is to protect them.

Without estate planning, it will be up to the court to appoint guardians for minor children if something happens to the parents.

To be sure, a court will do its best. However, in doing so, it will prioritize its own values, which may not align with those of the parents.

To put that more bluntly, many people have a relative who might look “good on paper,” but who may not be the first choice—for whatever reason—of the parents

Medical Decisions

In Kentucky, you have a fundamental right to make your own healthcare decisions.

But what if you do not have the capacity to make those decisions?

Well, if you have done no estate planning, then you won’t have a say in who makes decisions on your behalf.

Nor will you have a say in the decisions they ultimately make.

Additionally, those left to make decisions without your input may disagree, which can lead to family conflict that would need to be resolved by a Kentucky court.

Assets & Inheritances

Without estate planning, inheritances are received outright.

This is rarely ideal, especially for minor children, who will only have to wait until they turn 18 to receive the full amount.

The statistics indicate that many inheritances are squandered within a few years.

So, leaving an inheritance outright is a disservice to heirs. It also compromises your legacy.

Avoiding Probate

Probate is the process whereby some assets that were owned by a deceased person are distributed by a court.

Probate assets are all assets that are not distributed by the operation of law.

With estate planning, the probate of selected assets can be avoided through the use of a revocable living trust.

This can be worthwhile, depending on your unique circumstances, because the probate process can be expensive.

Further, the probate process can lessen the privacy of the family unit.

Thus, avoiding, or at least minimizing, the probate process can be important for some people.

Tax Planning

Estate planning can have serious transfer and income tax consequences.

The federal transfer taxes are the estate tax, the gift tax, and the generation-skipping transfer (GST) tax.

Additionally, a few states, including Kentucky, impose an inheritance tax.

With planning, the impact of these taxes on the family unit can be lessened.

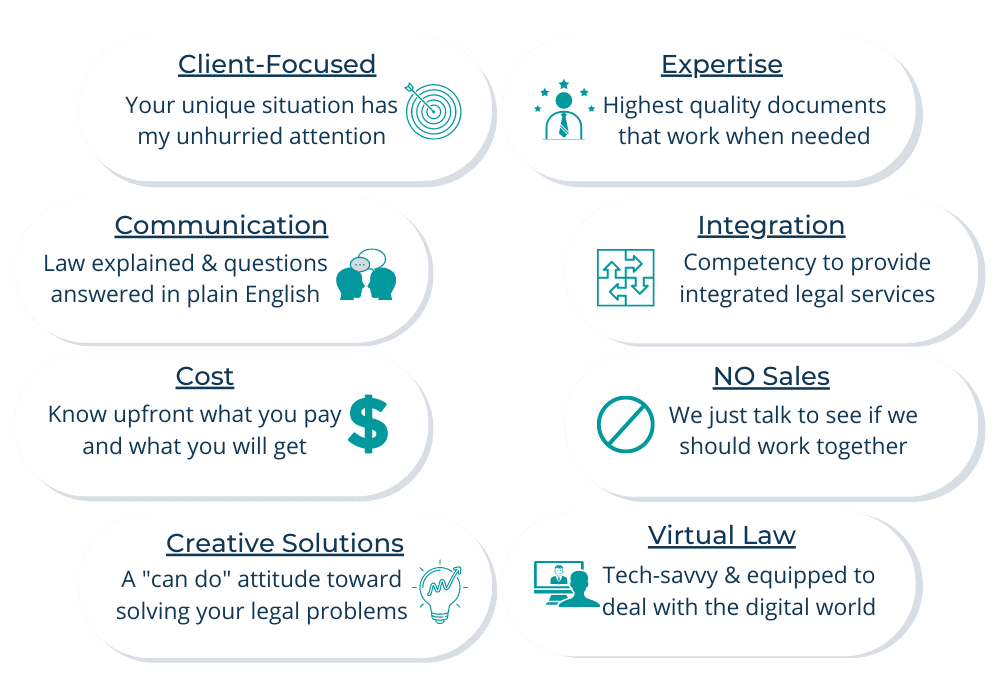

Why Choose DAP Estate Planning?

Estate Planning Lawyer vs. DIY

Many resources exist online—such as Legal Zoom—that provide dirt cheap estate planning. Truthfully, you can even find free forms online.

But, as the old adage goes, you get what you pay for.

If you review the terms of service of a site that provides a cookie-cutter solution, you will discover that they take no responsibility for their documents.

The truth is that for some people the generic documents can be fine.

(After all, the drafters had someone in mind when creating those documents)

Default Kentucky Estate Plan

It is important to realize that you have an estate plan even before you do any estate planning.

How is this possible?

Well, the law provides statutory defaults.

So, those who do not choose for themselves have choices made for them.

To be fair, the statutory defaults can be fine for some people.

However, most people should—due to persona preferences or objective considerations—change at least something. Really, multiple somethings.

Below is the default “estate plan” under Kentucky law.

Your Current Plan

I give my spouse 50% of my assets. I give my children the remaining 50%. But, if I have no children, then that share should go to my parents. If my parents have predeceased me, then to my siblings.

I appoint my spouse as guardian of my minor children. A court may mandate that amounts inherited by those minor children be held in a supervised account. My spouse should only have access to those amounts for limited purposes. Such access should always require court approval.

In the event my surviving spouse should die after me, I do not wish to nominate a guardian for any children who have not yet reached adulthood.

If my surviving spouse remarries, then the new spouse should be entitled to 50% of everything my surviving spouse possesses. The new spouse shall have no duty to support my minor children. Further, they shall have the right to dispose of everything they own, to the exclusion of my children (minor or adult), even if the amounts were once mine.

Finally, if I am incapacitated before I die, then I wish for my family to petition the court and go through the guardianship process so that my financial affairs can be managed.

Florence Office

DAP Estate Planning

73 Cavalier Blvd STE 129

Florence, Kentucky 41042

(859) 279-4160

Locations Served

I meet with estate planning clients in Covington, Independence, Erlanger, Fort Thomas, Florence, Newport, and surrounding areas in Kentucky.

I virtually serve estate planning clients throughout the rest of the bluegrass state.

I work with clients worldwide in the areas of asset protection and high-end tax planning.